The Importance of Proper Financial Management

Financial management skills are an increasingly important aspect of daily life. In order for many consumers to survive from one paycheck to the next, it is essential to adhere to a sound budgeting and effective planning techniques.

Financial management skills are an increasingly important aspect of daily life. In order for many consumers to survive from one paycheck to the next, it is essential to adhere to a sound budgeting and effective planning techniques.

The need to create savings is top of mind for many Americans today. According to one study conducted just a few years ago, over one quarter (26%) of American adults have no savings set aside for emergencies. Another 36% have not yet started to save for retirement. While most of these consumers are managing to pay for routine budget items, it's clear that an unexpected expense may create strain on their finances.

On the other hand, when individuals seize control of their finances, they are better able to weather such unexpected economic storms. Moreover, they maneuver themselves into a much better position to reach their financial and personal goals. If nothing else, that makes financial management a key ingredient in the recipe for peace of mind.

Some Financial Management Difficulties

Paradoxically, the world we live in makes financial management both easier and harder to implement at the same time. For the average individual, there may be several hurdles that stand in the way of effective financial management, such as:

- Multiple streams of income. Government data suggests that approximately 5% of American workers hold down multiple jobs. Some experts suggest that this is a very low estimate. In any event, living off multiple income streams may be necessary, and even desirable, but makes effective financial management that much harder, since pay may come in at different times throughout the month, or come via multiple platforms.

- Multiple bank accounts. Another obstacle to personal financial management is managing multiple bank accounts; perhaps one in a traditional institution, another with an online firm and so on. With two or more accounts to juggle, effective oversight of personal finances can quickly become a complicated endeavor.

- Ease of purchasing. In generations past, if you wanted to buy something on a whim you would need to have the cash on hand (or at least a checkbook nearby). Nowadays, credit cards have in many scenarios rendered paper money virtually obsolete; and they've also encouraged consumers to give in to their desire for instant gratification. In addition, online store sites often take the sting out of impulse buys, without removing the negative impact of shortsighted decision making. The bottom line? Modern technology has enabled impulse purchasing on an unprecedented scale, which makes personal financial discipline that much harder to maintain.

The good news is, modern technology has also enabled the development and implementation of financial management tools, which can help individuals to overcome the above-mentioned hurdles and get a firm grasp on their personal finances. One exceptional financial management tool available to account holders at Third Coast Bank is My 360 View.

My 360 View and You

My 360 View offers a number of practical, helpful features to streamline and simplify your personal financial management. These features include the following:

Dashboard

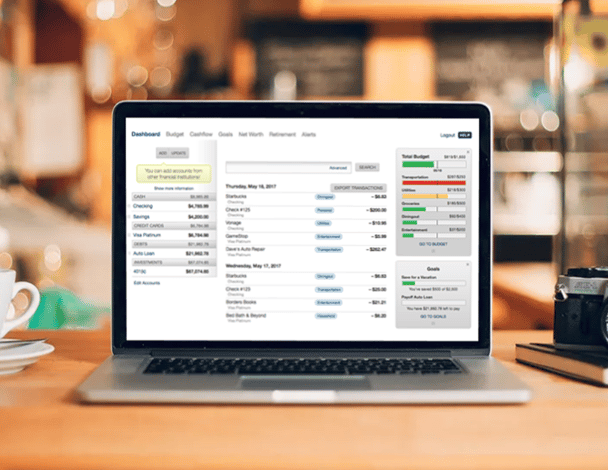

The My 360 View Dashboard offers a comprehensive, customizable view of your accounts, transactions, budgets, and financial goals. It includes helpful sub-features, such as:

- A list of all your accounts (internal and external). With this feature, you no longer have to navigate to multiple websites to keep a pulse on your financial status. The dashboard offers you a snapshot on the status of each one of your accounts, making it easier for you to know where you stand.

- A detailed transaction feed. Have you ever found yourself wondering whether a check has cleared, or whether you already paid an outstanding bill? My 360 View's detailed transaction feed can help you to locate specific payments or withdrawals, see which account they affect, and categorize them by labels.

- Customizable widgets. You can also tailor widgets according to what's important to you. For instance, if you want to save for a trip out of country, then a budgeting widget can provide you with a visual snapshot on how much you've already set aside, and how much more you need to save in order to reach your goal.

The My 360 View Dashboard is a wonderful high-level feature that can help you to more easily manage your personal finances, with less hassle.

Account Aggregation

My 360 View allows you to consolidate information from all of your accounts (both internal and external) in one location. Adding an account is easy. Simply click the Add button in the Accounts Section, and either choose one of our following defaults or search our database for another banking institution. Subsequently, all of your selected accounts will be displayed in aggregate in the same section.

Consumers who hold accounts at multiple banks often find it a struggle to effectively keep track of their cash flow. For instance, self-employed account holders may have a difficult time tracking down invoices, business expenses, and other necessary information if two or more accounts are in play.

However, My 360 View's Account Aggregation feature eliminates most of the stress that comes from holding multiple accounts at multiple locations, simply by consolidating key account data in one easily accessible place. In turn, this contributes to more streamlined financial management, with fewer headaches.

Tagging Transactions

My 360 View also enables you to add or edit customized tags for each one of your transactions. This is a practical aid for account holders that want to budget their income in an efficient manner. Instead of trying to determine which spending category a transaction should go in several weeks after the fact, the tagging feature allows you to determine the nature of the purchase at a glance. You can even sort your transactions by specific tags.

In addition, split tagging allows you to cleanly label transactions that don't neatly fit into a single category. For instance, if a purchase could be classified under both the Business and Personal tags, then a split tag becomes an easy compromise. This feature lets individuals gain a more detailed view of their spending habits, and thus take back control of their budget.

Transaction Search

In addition to transaction tagging, the transaction search feature allows you to quickly and easily find a specific purchase, payment, or invoice. The search can be based on specific words, tags, or even dollar amounts. Simply type a key phrase into the transaction search bar, and the system will retrieve all relevant items for your consideration.

This is an exceptional measure for fraud prevention, since an out-of-place transaction could be your first sign that someone has stolen your identity. It is also an excellent means of staying organized. For instance, if you want to determine how much you spent on dining out at one particular restaurant in a given month, all you have to do is type the restaurant name into the search bar and look for the time stamps.

In short, this feature makes fraud harder and financial management easier.

Budget

Developing and implementing a realistic budget is a crucial step on the road to financial well-being. A good budget can help you to avoid spending money that you don't really have, and save the money that you do have for the things that are most important to you.

Developing and implementing a realistic budget is a crucial step on the road to financial well-being. A good budget can help you to avoid spending money that you don't really have, and save the money that you do have for the things that are most important to you.

The My 360 View's Budget feature enables users to set spending targets and create budgets based on customized tags. This means that your budget can be as basic or as detailed as you desire: the sky is the limit.

In order to add a spending target to your budget, simply enter the tag or tags that you want to track, create a name for the spending target, and then set the monthly limit for that category. This is a great way to keep your spending habits in line with your budget, even if (like most people) you are occasionally forgetful. In fact, Third Coast Bank will send you a friendly reminder via text or email when you get close to the pre-set limit.

Cash Flow

Cash flow is a measure of the regular transfer of money into and out of your account. My 360 View's Cash Flow Calendar feature allows you to visualize when bills are due, and when you can expect to be paid. This can help you to intuitively monitor your current financial status. It can also serve as a key reminder for upcoming bills.

This practical feature promotes financial well-being by preventing you from incurring late fees or overdraft charges, and providing a high-level snapshot of where your money is going each month.

Goals

Setting financial goals is a critical element of effective wealth management. Whether you need to pay off outstanding credit card debt, or want to save for a new car, keeping pre-defined objectives in mind will help you to focus your resources on the more important things.

Setting financial goals is a critical element of effective wealth management. Whether you need to pay off outstanding credit card debt, or want to save for a new car, keeping pre-defined objectives in mind will help you to focus your resources on the more important things.

My 360 View's Goals feature allows you to set highly customized financial objectives. Goals can be categorized by type and savings amount, and the Summary page provides an overview of your progress, as well as how much you need to save each month in order to meet a certain deadline.

This feature helps you to stay on track financially (and mentally), and thus reach important goals in the shortest amount of time.

Net Worth

Your assets include all of your financial resources, expressed as cash, stock equity, real estate, and so forth. Debts, of course, require no explanation.

Net worth is a measure of the value of all your assets, minus your debts, or liabilities. Your net worth is an important metric to keep track of, since it is perhaps the most accurate representation of your current financial status, taking into account not only income and outstanding debts, but also other assets that you may not think about very often.

My 360 View contains a Net Worth Calculator that updates your net worth on a daily basis. It features a visual graph of your assets versus your liabilities, and can be easily edited to include new data.

With My 360 View, you no longer need to spend precious time manually calculating your net worth. Instead, with the click of a button you can use this intuitive, streamlined feature to obtain a clear picture of where you stand financially.

Alerts

For reminders to stay on budget, to pay a bill, or to continue towards a specific goal, My 360 View's Alerts feature offers unparalleled functionality. There are 6 main alert types that you can set for yourself:

For reminders to stay on budget, to pay a bill, or to continue towards a specific goal, My 360 View's Alerts feature offers unparalleled functionality. There are 6 main alert types that you can set for yourself:

- Account balance - This alert lets you know when a specific account's balance falls below a certain threshold.

- Spending target - TCB will notify you when you've spent a pre-defined percentage of a spending target.

- Goal progress - This alert notifies you when you've achieved a milestone towards a financial goal.

- Bill reminder - My 360 View will send you an alert that a bill is due in x number of days.

- Large transaction - Any time a transaction is posted that's over a pre-defined threshold, My 360 View will alert you.

- Merchant name - This alert notifies you when a transaction is posted from a specific store.

These alerts can help you to avoid late fees on bills, enable you to detect fraud early on, and assist you to stay on track with your personal financial objectives, to highlight just a few benefits of this feature.

The Benefits of Banking with TCB

Apart from the benefits of utilizing an advanced financial management tool as discussed above, banking with TCB offers several other advantages. For instance:

- Online banking is easy and convenient. You'll never need to wait in long lines at a physical branch location to deposit a check, pay a bill, or perform other routine but necessary business.

- We offer state of the art financial tools and technology to our customers. From mobile deposits to downloadable account history to advanced treasury management solutions, we have what you need to feel financially secure.

- Our relationship bankers provide a personal touch. We started small, and despite our company's growth we still carry our grassroots values with us wherever we go. Our experienced bankers will always work closely with you to find the best possible solution for your financial needs.

If you'd like to reap the many benefits of partnering with Third Coast Bank, reach out to us and open an online account today.

.png?height=50&name=Campaign%20Hero%20Ad%20%20(1).png)

.png?height=50&name=Untitled%20design%20(2).png)